735,000

Internet Users

32.5%

.km

237,200

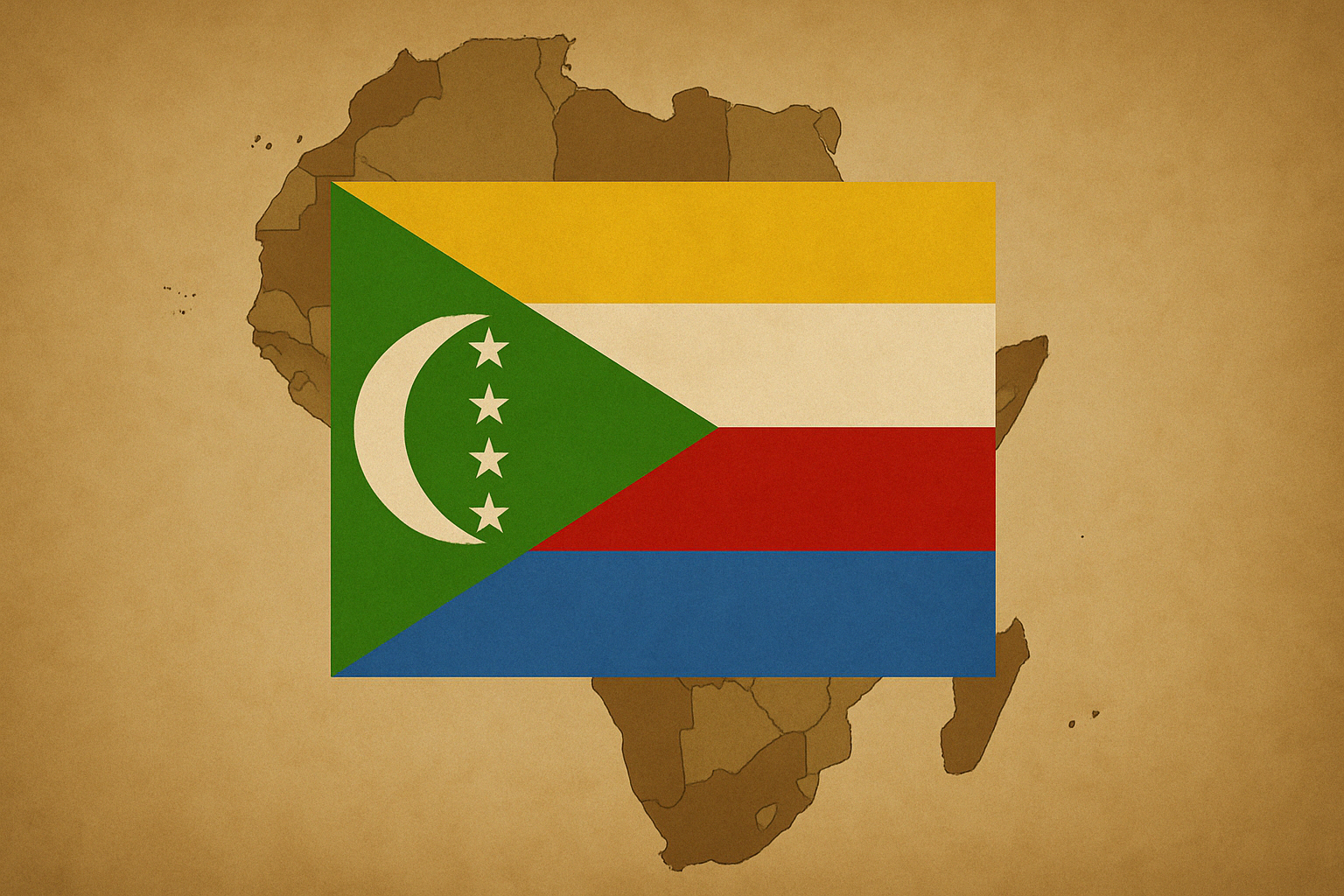

Sell online in Comoros

Comoros Economy: A Digital and Economic Overview for Investors and Marketers

Comoros – officially the Union of the Comoros – is a small island nation with a unique economic landscape and emerging digital scene. This comprehensive overview examines the country’s geographical context, economic overview, internet access and digital penetration, digital ecosystem, and online and digital marketing landscape. Geared toward investors and marketers, it highlights key facts, recent data (2023–2024), and trends shaping Comoros’ economy and its nascent online market. The goal is to provide a clear understanding of Comoros’ business environment and digital potential.

Geographical Context of Comoros

Location and Composition

Comoros is an archipelago in the Indian Ocean at the northern end of the Mozambique Channel, positioned between northeastern Mozambique on mainland Africa and northwestern Madagascar. It consists of three major volcanic islands – Grande Comore (Ngazidja), Anjouan (Ndzuwani), and Mohéli (Mwali) – along with numerous smaller islets. (A fourth island, Mayotte, is geographically part of the archipelago but remains under French administration and is not part of the Union of Comoros.) The country’s land area is modest (about 1,861 km²), making it one of Africa’s smallest nations by territory. The capital city Moroni is located on Grande Comore and serves as the political and economic center of the union.

From a demographic perspective, Comoros has a population of roughly 860,000 (as of early 2024), which is growing around 2% annually. The population is exceptionally young – over 50% are under the age of 20, and the median age is only about 20.6 years. This youthful demographic presents both opportunities and challenges: a large upcoming labor force with tech-savvy youth, but also pressure to create jobs and modern infrastructure. Population density is high (over 450 people per km² on average), particularly on the fertile islands of Anjouan and Mohéli. The majority of Comorians live in rural villages and small towns; only about 30% of the population resides in urban centers, reflecting the country’s heavy reliance on agriculture and fishing in rural communities.

Strategic and Economic Significance

The location of Comoros gives it strategic significance in the southwest Indian Ocean region. The archipelago sits along the maritime route of the Mozambique Channel, a key corridor for shipping between the Indian Ocean and Southern Africa. In theory, this position could enable Comoros to serve as a logistical hub or refueling stop for maritime trade. Moroni’s port and other small harbors handle inter-island commerce and imports from surrounding regions, though they are limited in capacity. Comoros is also a member of regional organizations like the African Union and the Indian Ocean Commission, and in recent years it joined the Southern African Development Community (SADC), aiming to integrate more with regional trade networks. Its proximity to East African markets (Mozambique, Tanzania, Kenya) and to Madagascar means Comoros could leverage regional commerce and tourism linkages as infrastructure improves.

Beyond trade routes, Comoros holds economic significance in niche agricultural markets. Despite its tiny size, the country is one of the world’s leading producers of ylang-ylang, a fragrant flower distilled into essential oil for perfumes. It also produces high-quality vanilla and cloves, making these islands important to global spice and fragrance supply chains. Investors in specialty agriculture and agribusiness consider Comoros’ climate and volcanic soil favorable for these cash crops. The rich marine environment around the islands also provides abundant fisheries (fish is a staple of local diets and a potential export commodity), and unspoiled coral reefs and beaches give Comoros considerable tourism potential as a tropical destination.

At the same time, Comoros faces the classic challenges of a small island developing state (SIDS). It is relatively isolated from major markets, which raises transportation costs for trade. The country is not self-sufficient in food – for example, it must import the majority of its staple rice and almost all refined fuels – making it vulnerable to external price shocks and supply disruptions. Limited land and natural freshwater constrain large-scale agriculture and industry. Comoros is also highly vulnerable to climate-related risks: cyclones, heavy rains, and even volcanic activity (Grande Comore is home to Mount Karthala, an active volcano) threaten lives, infrastructure, and economic stability. These geographic and environmental factors mean that while Comoros has some strategic advantages, it also requires significant investment in climate resilience, infrastructure, and connectivity to fully capitalize on its location.

Despite the hurdles, Comoros’ position at the crossroads of Africa and the Indian Ocean gives it a unique cultural and economic blend – influenced by African, Arab, and French ties – and a potential role (albeit limited) in regional trade and tourism. For business stakeholders, understanding Comoros’ geography underscores why certain sectors (like inter-island transport, agriculture, and telecom connectivity) are so crucial, and why the government and donors emphasize infrastructure development (roads, ports, energy) to overcome the disadvantages of insularity.

Economic Overview

GDP and Growth Trends

Comoros has a small, low-income economy characterized by modest output and heavy dependence on a few sectors. As of 2023, the country’s gross domestic product (GDP) is approximately $1.4 billion (in nominal terms). GDP per capita stands around $1,500–$1,600, which places Comoros among the poorer nations in the world (well below the global average of about $10,000 per capita). Economic growth in recent years has been positive but subdued, reflecting both the country’s structural challenges and some recovery from global shocks. Real GDP growth was roughly 3% in 2023, up from near-stagnant growth in the pandemic years. Early estimates for 2024 indicate growth accelerated slightly to about 3.4%, spurred by specific investments and a rebound in services. If confirmed, this would mark one of the better growth performances of the past decade for Comoros (which historically averaged around 2–3% annual growth).

This recent uptick follows a difficult period during 2020–2021 when Comoros, like many countries, felt the impact of COVID-19. The pandemic led to a brief contraction in economic activity (due to disrupted trade, a tourism halt, and lockdown measures), but the contraction was relatively mild given the limited size of the formal economy. By 2022, growth resumed (though still under 2% that year). In 2023, the economy “rebounded” as anticipated by policymakers: transport and social activity normalized, the tourism sector began to welcome visitors again, and several public infrastructure projects gained momentum. Real output expansion in 2023–2024 has been driven mainly by the services sector and construction activity, while agricultural output had mixed results due to weather fluctuations.

Looking ahead, Comoros’s government has outlined an ambition for higher growth under its Plan Comores Émergent 2030, an economic development roadmap aiming to transform the country into an emergent economy by 2030. Targets include reaching annual growth of 4% or higher in the coming years – a level achieved only a few times in recent history. Achieving this will depend on continued investments, political stability, and the country’s ability to leverage external support. It’s worth noting that in August 2024 Comoros became the 165th member of the World Trade Organization (WTO) after 17 years of accession negotiations. WTO membership could eventually help integrate Comoros into the global trading system more fully, potentially stimulating trade-led growth and giving confidence to foreign investors through more predictable trade rules. However, any growth acceleration also faces risks: Comoros remains vulnerable to commodity price swings, climate shocks (like the torrential rains in early 2024 that caused local damage), and global economic slowdowns that could affect aid and remittances inflows.

Key Sectors and Industries

The structure of Comoros’s economy is relatively simple, with a heavy reliance on primary industries and a nascent industrial base. The agriculture sector is the backbone of the economy. Broadly defined (including farming, fishing, and forestry), agriculture contributes an estimated 30–40% of GDP and provides livelihoods for the vast majority of Comorians. It is estimated that two-thirds to four-fifths of the labor force work in agriculture or related rural activities, mostly at the subsistence or smallholder level. The country’s volcanic soil and tropical climate allow cultivation of a variety of crops. Key food crops for domestic consumption include cassava, plantains, sweet potatoes, and coconut, but yields are generally low and the country cannot meet its own food needs. Rice, the staple of the Comorian diet, is mostly imported and constitutes a large share of import spending.

Within agriculture, the cash-crop and export sub-sector is particularly significant for generating foreign exchange. Comoros is famed for its cultivation of vanilla, cloves, and ylang-ylang:

Vanilla – Comoros produces high-quality vanilla beans. Although overshadowed by neighboring Madagascar (the world’s largest vanilla producer), vanilla is a top Comorian export. Vanilla prices spiked globally in recent years, which benefited farmers, but volatility is high and output has been affected by cyclones and plant disease.

Cloves – Comorian cloves (used as a spice and in clove oil production) are a major export earner. Comoros, Zanzibar (Tanzania), and Indonesia are among the leading global producers of cloves. In good harvest years, clove exports from Comoros bring substantial revenue. For instance, the UAE and India have been notable buyers of Comorian cloves recently.

Ylang-ylang – Perhaps Comoros’s most iconic product, ylang-ylang flowers are distilled into essential oil. Comoros is often cited as the world’s largest producer of ylang-ylang essential oil, a prized ingredient in luxury perfumes. This niche export has put Comoros on the map in the fragrance industry, with France and other perfume-manufacturing countries as main customers.

In addition to these, the country also exports smaller quantities of other agro-products like vanilla extract, copra (dried coconut), and certain fruits or beans, but those are marginal compared to the “big three.” The dominance of these crops means Comoros’s export earnings are highly concentrated and exposed to weather and price fluctuations. A poor harvest season or drop in global vanilla/clove prices can sharply reduce GDP and export income in a given year (for example, provisional data showed merchandise export revenues actually fell in 2023 by over 40%, likely due to a downturn in vanilla/clove output and prices, highlighting the volatility).

The industrial sector in Comoros is very limited – industry (manufacturing, mining, utilities, construction) might account for only around 10–15% of GDP. There is no significant mining or heavy industry in Comoros. Manufacturing is mainly agro-processing (such as vanilla curing and distillation of ylang-ylang oil, production of scented soaps or oils, simple food processing, and small-scale handicrafts). There are a few small factories and workshops, but most manufacturing is cottage-level. One bright spot is construction, which has seen growth due to public infrastructure works and diaspora-funded building. In 2023–2024, construction activity picked up thanks to projects like the El Maarouf Hospital reconstruction (the main public hospital) and the development of a new Galawa Beach Hotel resort. These projects, often funded by international partners (e.g. Gulf states or donors), not only create construction jobs but also aim to lay the foundation for better healthcare and tourism capacity, respectively. Still, given the tiny industrial base, even robust growth in construction or manufacturing translates to a modest impact on overall GDP.

The services sector is increasingly important, now accounting for roughly half of GDP. This broad category includes government administration, trade and retail services, transportation, telecommunications, financial services, tourism, and other professional services. Government and public services form a substantial part of the formal economy (the state is a major employer in education, health, and administration). Retail and commerce thrive on imported consumer goods (from foodstuffs to fuel and manufactured products). Telecommunications has become a dynamic part of services since the sector liberalized (the introduction of a second mobile operator in 2016 spurred investment, more on this in the digital sections). Financial services remain shallow – there are only a handful of banks (including the central bank, a couple of commercial banks like Exim Bank Comores, and microfinance institutions) – but efforts are underway to broaden access to finance.

Tourism, while currently modest, is a service industry with notable upside potential. Comoros sees only a few tens of thousands of visitors per year, many of them Comorian diaspora or business travelers. The leisure tourism infrastructure is underdeveloped (few hotels of international standard, limited air connections), but the government has identified tourism as a growth sector. Pristine beaches, marine parks, and the unique culture (a mix of Swahili, Arab, and French influences) are assets for attracting niche tourists seeking off-the-beaten-path destinations. The planned Galawa hotel, for instance, is a bid to create a resort that could draw regional tourists (perhaps from South Africa or Gulf countries). If such investments continue, tourism receipts – which already form the bulk of Comoros’s services exports – could rise significantly, contributing more foreign exchange and jobs.

Employment and Income

Given the dominance of subsistence agriculture, employment in Comoros is largely informal. A huge portion of the population works as small farmers or fishermen, consuming much of what they produce and selling surplus in local markets. Formal employment opportunities are scarce, mainly found in the public sector, a few large firms, or services in Moroni. The official unemployment rate is paradoxically low (around 5–6% in recent estimates), but this figure is misleading in an economy where underemployment and informal work are rampant. In reality, many Comorians may be engaged in part-time farming or petty trade but lack stable, full-time jobs. Youth unemployment is a pressing concern – about 11% of youth (15–24) are formally unemployed (and many more are underemployed or have given up job searching). With such a young population entering working age, job creation is a critical challenge. Each year, thousands of young Comorians leave school and find few opportunities; some pursue higher education abroad (especially in France or other Francophone countries), and a number seek to emigrate for work.

Remittances play an outsized role in household incomes. There is a large Comorian diaspora (estimated around 300,000 people) living mainly in France (including Mayotte and metropolitan France) but also in other European countries, the Gulf, and East Africa. These expatriate Comorians send money back to their families regularly. Remittances account for roughly 20–25% of Comoros’s GDP, among the highest rates in the world. This steady inflow of funds (often on the order of $100–200 million per year) significantly supplements domestic income, finances consumption and house construction, and helps reduce poverty for recipient families. In many villages, remittance-funded projects – new homes, small businesses, or community facilities – are evident. For marketers, remittances mean a segment of the population has access to disposable income sourced from abroad, which can translate into demand for consumer goods, telecom services, and housing materials. However, reliance on remittances also indicates vulnerability; if economic conditions worsen in host countries (or immigration rules tighten), these inflows could slow.

Poverty remains widespread in Comoros despite these inflows. Estimates suggest around 38% of the population lives below the national poverty line (data in recent years), with rural poverty rates higher than urban. Income inequality is notable, with a small urban elite (often connected to politics or business) enjoying a much higher standard of living than subsistence farmers. Many households struggle to meet basic needs, especially in years when food import prices rise or when crops fail. This context means that while there is some consumer market in Comoros, it is thin and concentrated in urban areas – an important consideration for investors assessing local purchasing power.

On a positive note, education levels have been improving gradually and the workforce is increasingly literate (Comoros has a literacy rate around 75% for adults, and higher for youth). Many Comorians are trilingual (fluent in the local Comorian language, French, and often Arabic), which can be an asset in service industries and in dealing with international partners. Entrepreneurial spirit exists, with many small informal businesses and trading activities ongoing, but entrepreneurs often cite lack of financing and the high cost of utilities and internet as constraints.

Inflation and Monetary Environment

Comoros operates in a unique monetary arrangement that has historically kept inflation relatively low by regional standards. The country uses the Comorian franc (KMF) as its currency. The KMF is pegged to the euro under an arrangement with France, a legacy of colonial ties and similar to (though separate from) the CFA franc currency zones in Africa. The current fixed rate (in effect since the euro’s introduction) is approximately 492 KMF to 1 EUR. This peg, supported by France’s Treasury, has provided a stable nominal anchor; as a result, inflation in Comoros has generally been moderate, typically in the low single digits annually. Over the decade prior to 2020, consumer price inflation averaged around 2–3% per year, reflecting the stability of the currency.

However, external shocks can still cause inflation swings because Comoros imports most of its food and fuel. In 2022, the global surge in commodity prices (especially fuel, cooking oil, and grain) led to a sharp spike in inflation. Inflation in Comoros climbed into double digits, averaging roughly 12% in 2022, which squeezed household budgets severely. The government tried to mitigate this through subsidies (for example, on energy) and administrative price controls on certain staples. By 2023, inflation decelerated significantly as international prices began to normalize and subsidy measures took effect. Average inflation in 2023 came down to an estimated 8–9%, still above the historical norm but a marked improvement over the prior year. By early 2024, inflation was further subsiding – forecasts pegged it around 3–5% for the year – essentially returning to a more normal range.

The Central Bank of Comoros (Banque Centrale des Comores) has limited independent monetary policy due to the currency peg. Key interest rates are low (the policy rate was about 2.0% at end-2022), aiming to support credit growth. The financial system is small and so is the transmission of monetary policy – most loans are short-term, and banking penetration is minimal (only about 25% of Comorians have a bank account, as of 2023). The government’s fiscal and monetary stability is partially underpinned by external support. Comoros is under an Extended Credit Facility (ECF) program with the IMF, which it entered in 2021 to help stabilize and reform the economy. The IMF program has encouraged fiscal discipline and reforms in tax administration, while providing concessional financing. So far, Comoros has maintained a relatively prudent fiscal stance: prior to recent developments, the fiscal deficit averaged near balance (around 0% to 2% of GDP) in the late 2010s. In 2023, the fiscal deficit was around 2–4% of GDP as the government increased spending on public wages and projects while revenues lagged slightly (partly due to tax exemptions and teething issues in tax collection). Public debt has risen but remains moderate at about 37% of GDP (2024), much of it owed to multilateral and bilateral partners on concessional terms.

For investors, the stable currency and predictable inflation environment are positives – unlike some neighboring countries, Comoros doesn’t suffer from rampant inflation or volatile exchange rates. This stability helps businesses plan costs (especially important for importers of goods). The downside is that the fixed currency can be overvalued relative to productivity, potentially making Comorian exports less competitive without productivity gains. Another consideration is that, due to limited domestic credit, foreign investors often rely on external financing or partnerships to fund projects (local banks are small and often risk-averse, with high non-performing loan ratios around 17%). The government’s commitment to reforms (such as widening the tax base, improving public finance transparency, and restructuring loss-making state enterprises like the postal bank) may gradually improve the business climate and investor confidence in the macroeconomic framework.

Trade and Investment Climate

Comoros runs a structural trade deficit, importing far more than it exports. The economy’s narrow production base means it exports only a few commodities while needing to import almost all manufactured goods, fuel, vehicles, and even much of its food. In 2023, total merchandise exports were on the order of just $30–35 million, whereas merchandise imports were about $350–360 million – a trade gap of over $300 million that is typically financed by foreign aid, remittances, and some debt. Services trade offers a slightly better picture: Comoros earned around $120 million from services exports (mostly tourism and transport services) in recent data, against about $190 million in services imports, but it still runs a deficit in services too. The current account deficit (which includes trade, services, remittances, and aid flows) is usually in the range of 3–5% of GDP. Despite large remittance inflows that count as income in the current account, the high import bill keeps the external accounts in the red.

Export composition is highly concentrated. The three main export goods – vanilla, cloves, ylang-ylang oil – routinely make up the majority of export earnings (often 80% or more of goods exports combined). In some years, Comoros also exports small amounts of frozen fish, spices like pepper, or scrap materials, but those are not major. There have been discussions about diversifying exports by promoting things like fisheries (tuna) or tourism services, but these are still at early stages. One interesting minor export is the trade in postage stamps – as a legacy of being a lesser-known country, Comoros has in the past sold collectible stamps to philatelists abroad, but this is a trivial portion of revenue.

Import composition reflects basic needs and the lack of domestic industries. Key imports include: foodstuffs (rice, wheat flour, sugar, cooking oil, poultry, etc.), fuel and energy (petroleum products for transport and electricity generation – there is no local oil or gas production), cement and building materials, vehicles and machinery, medicines and medical equipment, and consumer goods (from clothing to electronics). A significant import expense is also tied to the nation’s electricity sector: Comoros generates power largely from imported diesel, and the inefficiencies there mean heavy fuel imports. In 2025 the import bill is expected to rise further with one-off imports of generators and energy equipment to upgrade the grid.

Major trading partners for Comoros have shifted somewhat over time. Traditionally, France was the dominant trade partner (taking a large share of exports like vanilla and supplying many imports). While France remains important – it still accounts for a noticeable portion of exports (particularly as the buyer of ylang-ylang oil for perfumeries, and source of various imports) – other partners have grown. In recent years, India and Indonesia import significant quantities of Comorian cloves (for their spice and tobacco industries). China has become the leading source of Comoros’s imports, providing everything from textiles to electronics and machinery; by 2023, about 24% of Comoros’s imports (the largest share) came from China. The United Arab Emirates (UAE) is another major partner: it has both exported goods to Comoros (around 20% of Comorian imports, including fuel and consumer goods) and imported Comorian products (notably almost all of Comoros’s clove exports in some recent years have gone to the UAE, likely for re-export or processing). Tanzania and other regional neighbors supply food staples (e.g., Tanzania often exports rice and poultry to Comoros). Pakistan and India are buyers of Comorian vanilla and ylang-ylang. France and Kenya appear in both export and import partner lists as well (France for perfumes/vanilla and as a source of vehicles, and Kenya sometimes supplies food products). The United States has emerged as a small but growing market for vanilla – high-quality Bourbon vanilla from Comoros finds its way into the U.S. via traders, though volumes are relatively low.

For an investor, Comoros’s trade profile underscores both the opportunities and limitations: the country could benefit from investment in sectors that currently drive imports (for example, food processing or light manufacturing to substitute some imports, or renewable energy to cut the costly fuel imports). Likewise, adding value to the existing exports (like vanilla processing into extracts, or expanding the volume of fisheries export) could help the trade balance. The government knows this, and part of its emergent plan is to encourage value-added activities and diversification. However, doing business in Comoros can be challenging.

The business and investment climate in Comoros is still developing. Historically, Comoros has ranked low on the World Bank’s Ease of Doing Business indices (in areas like starting a business, getting credit, and trading across borders). Bottlenecks include bureaucratic red tape, a weak legal framework for commerce, and sometimes unpredictable enforcement of regulations. The country has only nascent frameworks for things like investment promotion – there is an agency for investment promotion (ANPI) and efforts have been made to offer tax incentives for priority sectors (such as tourism and renewable energy). For example, an investor in a hotel may receive exemptions on import duties for construction materials. Comoros also set up a Special Economic Zone (SEZ) in the late 2010s (on the island of Grande Comore) to attract foreign investment in export-oriented industries, although progress on populating the SEZ with businesses has been slow.

On the positive side, Comoros’s government is actively seeking foreign investment and has political stability under the current leadership. President Azali Assoumani (re-elected in 2019 and again in early 2024) has provided continuity and emphasized infrastructure development and economic reforms. While the political system has had instability and coups in the past, the last few years have been relatively stable, which is encouraging cautious investors. The legal environment is influenced by French civil law, and the country is open to arbitration for disputes (Comoros adhered to some international investment dispute conventions). Labour is abundant and inexpensive (wages are low), though the workforce is not highly skilled for technical jobs.

Foreign investors in recent years have included telecom companies (e.g. Telma from Madagascar’s Axian Group in telecoms), energy firms (some interest in solar and geothermal energy development), and hotel developers (reports of interest from investors in the Middle East and South Africa in tourism projects). Foreign aid also plays a role akin to investment: large-scale projects are often financed by donors like the World Bank, African Development Bank (AfDB), European Union, or bilateral partners (France, China, the Arab states). For instance, the AfDB is financing roads and a new inter-island ferry, and China has funded government buildings and perhaps future port improvements. These projects can open opportunities for subcontractors and suppliers.

In summary, Comoros’s economy in 2023–2024 can be described as small but gradually improving, with key reforms underway. The nation’s strategic plan and recent WTO membership signal an intent to integrate into global markets. However, the immediate opportunities for investors may lie in niche areas where Comoros has a comparative advantage (agro-specialties, eco-tourism, fisheries) or in sectors where the domestic need is great (infrastructure, telecom, energy). For marketers, the economic landscape indicates that consumer purchasing power is concentrated in urban and diaspora-supported segments, and that products related to basic needs, communication, and remittance services will find the broadest market. Overall, any business venture in Comoros must account for the country’s scale and limitations – success will often hinge on tapping into external demand (for exports or tourist arrivals) or providing a service that efficiently substitutes an import or meets an underserved local need.

Internet Access and Digital Penetration

Connectivity and Infrastructure Development

Comoros’s digital connectivity has been improving, but it still lags behind much of the world. The country first connected to global telecommunications infrastructure in the 1990s via satellite links, and later via undersea fiber optic cables. Today, Comoros is connected to at least one major subsea cable – the Eastern Africa Submarine Cable System (EASSy) – which lands in the islands and links them to the high-speed internet backbone along Africa’s east coast. Despite this, domestic telecom infrastructure has been a bottleneck. For many years, a single state-owned company (Comores Telecom) held a monopoly, and internet access was limited and expensive. The introduction of a second telecom operator in 2016 (Telma Comores) broke the monopoly and sparked some competition, leading to gradual improvements in service offerings and coverage.

As of early 2024, Comoros had about 643,800 active cellular mobile connections, a number equivalent to ~75% of the population. This figure indicates that mobile phone ownership is fairly widespread (many people have at least one SIM card, and some have multiple SIMs for coverage or cost reasons). Mobile phones are the primary means of communication; landline telephones are almost non-existent outside of some offices, and fixed broadband internet lines are extremely scarce (virtually all internet traffic goes through mobile networks). According to the latest data, the country had fewer than 0.4 fixed broadband subscriptions per 100 people, highlighting that home or office wired internet is a rarity. Instead, Comorians access the internet via 2G, 3G, and increasingly 4G mobile networks provided by the telecom operators.

Mobile network coverage now extends to most populated areas on the three islands, but the quality and speed can vary. Comores Telecom (through its mobile arm branded as “HURI”) operates 2G and 3G nationwide and in recent years deployed what it calls 4.5G in major towns (essentially a 4G LTE service). Telma Comores launched with 3G and quickly rolled out 4G LTE on the 800 MHz band, bringing faster mobile data to the islands. By 2023, both operators offer 4G in urban areas like Moroni, Mutsamudu (capital of Anjouan), and Fomboni (capital of Mohéli), though rural coverage might still rely on 2G/3G. The entry of Telma and its investments (with up to 50 new base stations added in its first years) have slightly lowered prices and improved mobile internet speeds. Still, compared to global standards, Comoros’s mobile data is expensive relative to incomes, and speeds are in the basic broadband range. For example, a 1 GB data package might cost several US dollars, a significant sum for many Comorians. As a result, not everyone who has a mobile phone can afford regular internet access – many use their phones primarily for calls and SMS and only occasionally buy data.

Internet penetration – the share of the population that actually uses the internet – remains relatively low but is growing. By the start of 2024, an estimated 235,000 people in Comoros were internet users, which is about 27% of the population. In other words, roughly one in four Comorians is online. (Other sources using different methodologies have cited figures up to ~35%, but in any case, well under half the population is using the internet). This penetration rate is lower than the global average (~66%) and slightly below the average for Africa (~40%), reflecting the challenges of affordability and digital literacy in Comoros. The number of internet users has been rising slowly year-over-year – between January 2023 and January 2024, the user base grew by just around 4,000 people, an increase of under 2%. At this pace, it will take many years for Comoros to attain majority internet usage. The flip side is that there is a large untapped market of non-users (roughly 600,000 people, or 73% of the population, mostly in rural communities) who could come online if barriers are reduced. This represents a latent potential for future growth in digital services if infrastructure expands and costs come down.

Urban-rural disparities in internet access are significant. Internet use is concentrated in urban and peri-urban areas, where mobile network signals are stronger and incomes are somewhat higher. For instance, Moroni and its environs have cyber cafés, Wi-Fi hotspots, and many smartphone users active on social media. In contrast, in remote villages, many people either have no network coverage or only a basic phone with no internet capability. Around 30% of Comorians live in cities, and these tend to be the bulk of the online population. Gender disparities also exist: anecdotal evidence suggests fewer women have access to personal internet devices than men, though exact figures are not well documented (cultural norms and lower mobile ownership among women might contribute to this gap).

The infrastructure development efforts underway aim to improve both access and quality. A notable initiative is the AfDB-funded digital development project launched in 2024 with nearly 9 million euros in financing. This project includes building a new national data center, upgrading a secondary data center, and creating a technology incubator to foster digital innovation. The data center will provide local hosting for government and business applications, improving speed and data sovereignty (currently, most internet traffic and data storage go through servers outside Comoros). The plan also involves setting up a digital government platform to offer e-services to citizens (like e-payments, online administrative procedures) and an interoperable system for government databases. Crucially, the initiative will establish a National Authority for the Protection of Personal Data and Access to Information, indicating Comoros is developing a regulatory framework for data privacy in line with global norms – an important step to build trust in online services.

Furthermore, the project will invest in digital skills training, including support to the University of Comoros to enhance ICT education. These improvements, while not immediately transforming connectivity on the ground, lay the groundwork for a more robust digital ecosystem in the coming years. If the data centers and digital platforms are implemented, businesses could benefit from local hosting options and potentially more reliable connectivity domestically between the islands. There is also an ongoing World Bank inter-island connectivity project that looks to improve the telecom links between Grande Comore, Anjouan, and Mohéli (possibly via a dedicated inter-island subsea cable or microwave links) to ensure that even the smaller islands have equal access to bandwidth.

Importantly, the presence of two telecom operators means Comoros has a competitive market structure in telecom, albeit a duopoly. Comores Telecom (Huri), the incumbent, still has a wide reach and legacy infrastructure (for example, it runs the only fixed telephone network and the .km domain registry). Telma Comores, as part of the Axian Group (which has telecom operations in Madagascar, Tanzania, etc.), brings international expertise and capital. Telma’s introduction of mobile money services (branded Mvola, as in Madagascar) and aggressive marketing of 4G has started to change user habits. Comores Telecom, not to be outdone, launched its own mobile money platform (Huri Money) and mobile app Huri Yatru to offer various digital services. The competition has also led to more creative bundles (e.g., voice/data packages, social media passes) to entice users to use data.

From an investor or marketer perspective, the trajectory of internet access in Comoros suggests that while the audience size is currently limited, it is growing and likely to accelerate as infrastructure projects complete. The fact that roughly a quarter of the population is online means any digital campaign or product instantly has a capped reach – you can realistically only reach those ~200-250k people who are internet users, most of whom are young, urban, and at least moderately educated. However, each year a few more percent of the population will join them, especially if smartphone prices keep falling and network coverage extends. It’s also noteworthy that even among those with internet access, usage might be intermittent or primarily via public Wi-Fi or shared devices, due to cost. That shapes the kind of digital content that can succeed (low-bandwidth, mobile-friendly services have an edge).

Internet Usage Patterns and Challenges

Among the Comorians who do use the internet, mobile internet is king. Essentially all internet users are on mobile devices (smartphones or feature phones with internet capability). There are very few fixed-line internet users except within certain institutions. This means that internet usage patterns center around activities feasible on mobile: social media, messaging apps, light browsing, and some video consumption. Data usage per user is likely limited by cost; heavy activities like streaming HD video or downloading large files are not common except for a small segment of users.

Social media and communication apps dominate how Comorians use the internet (we will explore the most popular platforms in the next section on the digital ecosystem). Facebook, WhatsApp, and YouTube are among the top applications. Many people use the internet primarily for keeping in touch with family (especially diaspora relatives via WhatsApp or Facebook Messenger), getting news (through social media or news sites), and entertainment (short videos, music). Email usage is less widespread outside professional circles – many younger Comorians might skip email entirely and use messaging apps as their main communication channel. E-commerce usage is currently very limited (lack of local e-commerce sites and online payment options is a factor; more on that later).

One can characterize Comoros’s stage of internet adoption as early-stage but emerging. There is an enthusiasm for connectivity among the youth – for instance, when 4G launched, many young people in Moroni bought data to experience faster internet, and TikTok usage surged in that demographic. However, the high cost of data (relative to incomes) remains the number one barrier to more intensive use. A person in Comoros might spend a significant portion of their monthly income to get even a few gigabytes of data. To cope, users often wait for off-peak hours when some networks offer cheaper night data, or they take advantage of promotions (such as free Facebook access or social bundles that some carriers in Africa provide – though it’s unclear if Comorian operators offer zero-rated social media access yet).

Another challenge is digital literacy. While most young people can navigate smartphones easily, older generations and rural folks may lack the knowledge or confidence to use the internet. There are initiatives by NGOs and telecom firms to educate people on basic internet use, but these are nascent. Language can also be a barrier: much content online is in English or French, and while French is an official language taught in schools, the true fluency in French among rural populations can be limited. Efforts to create local content in Comorian (Shikomori) or simplified French could help engage more users. The government has begun to put some forms online (mostly in French) and to disseminate information via social media in both French and Comorian.

Power supply issues also affect internet usage. Comoros has an unreliable electricity grid with frequent outages. Many rural areas have no electrification at all. Even in Moroni, rolling blackouts are common. This means charging phones is not always a given; people have to ration battery use or use generators/solar panels to keep devices powered. Internet towers themselves sometimes go offline during power cuts (though some have solar or generator backups). The expansion of solar home systems in villages and improvement of the power grid (with generator imports and planned renewable projects) will indirectly boost internet usage by making it easier to keep devices charged and networks running consistently.

On the positive side, the small geography of Comoros makes it easier to achieve near-total network coverage if investments are made – just a few dozen more cellular towers could cover many remaining populated pockets, given each island’s limited size. Also, the fact that Comoros is part of international fiber networks means that the potential bandwidth available is high (the country is not stuck on satellite with narrow bandwidth as some remote places are). The key is bringing that bandwidth affordably to end-users. The telecom regulator and government have considered strategies like sharing infrastructure between operators and using universal service funds to extend coverage. If these plans progress, one could see internet penetration climb to, say, 40–50% in the later 2020s.

For now, marketers targeting Comoros should note that any digital campaign must be mobile-centric and low-bandwidth optimized. Websites should be light and mobile-friendly, videos should have subtitles (many watch without sound or in low quality), and utilizing popular social platforms will yield far more reach than standalone websites or apps due to user habits. Understanding the constraints (like sporadic access and cost sensitivity) is crucial – for instance, expecting users to download a large app or continuously engage might be unrealistic, whereas a clever Facebook campaign or WhatsApp outreach could be more effective under current conditions.

In summary, Comoros’s internet access situation in 2023–2024 is one of slow but steady progress. Approximately a quarter to a third of Comorians are online, almost entirely via mobile. The country has laid some groundwork for a digital leap with investments in infrastructure and a second telecom operator spurring competition. Major challenges like high costs, limited coverage in rural areas, and power reliability still temper the pace of digital penetration. Nonetheless, the direction is positive – each year new users are coming online, and those who are connected are increasing their engagement with digital services. For investors in the telecom and tech space, this is a market with significant growth headroom (there is a large unconnected population to serve). For marketers, it’s a market where digital channels are emerging as important, especially for reaching the urban youth demographic, even as traditional media still dominate the mass audience.

Digital Ecosystem in Comoros

Popular Online Platforms and Services

The digital ecosystem in Comoros is largely defined by the use of global platforms; there are few indigenous online services at scale. Among internet users in Comoros, the most popular online platforms mirror those in many other countries, with social media and messaging apps taking the lead:

Facebook – Facebook is the single most widely used social network in Comoros. With an estimated 237,000 Comorian Facebook accounts (early 2024 data), Facebook’s user base is equivalent to about 27.6% of the population – essentially reaching nearly every internet user in the country. Facebook’s dominance is such that for many Comorians, being “online” primarily means being on Facebook. They use it to maintain personal connections, follow news (via pages/groups), and engage with businesses or public figures. Facebook is also used as a de facto e-commerce and advertising platform by local entrepreneurs (selling items on marketplace or via posts) due to the lack of local online marketplaces. For marketers, Facebook’s importance in Comoros cannot be overstated – it offers the largest addressable online audience in one place.

WhatsApp – This messaging app is ubiquitous on the islands for those with smartphones. While precise user numbers are not published (since WhatsApp doesn’t require public profiles), virtually everyone who has a data-enabled phone uses WhatsApp for communication. It has largely replaced SMS for daily texting and voice notes, and is popular for group chats (families, work groups, community groups). Many businesses use WhatsApp to communicate with customers one-on-one – for instance, a shop might take orders or arrange deliveries via WhatsApp messages. Its end-to-end encryption and low data usage make it ideal for Comoros. In terms of reach, WhatsApp likely connects a similar number of people as Facebook, or more, since even some who avoid social media still use WhatsApp for its utility.

YouTube – As a platform for video content, YouTube has a growing following, especially among younger Comorians. Music videos are extremely popular (Comorian youth frequently watch the latest global and regional hits on YouTube). Educational and religious content (like lectures, tutorials, Quran recitations) is also accessed. However, YouTube’s heavy data usage can be a limiting factor – many users might save YouTube for when they have a Wi-Fi connection or use the lowest resolution. Google’s statistics indicated a significant number of YouTube users in Comoros via its ad reach data, but the exact percentage of population reachable on YouTube is not confirmed publicly. It’s likely a smaller audience than Facebook, but still notable among urban youth and educated segments.

TikTok – TikTok has made rapid inroads among the youth of Comoros. ByteDance’s advertising data showed around 122,500 users aged 18+ in Comoros were reachable via TikTok ads in early 2024, equivalent to roughly 25% of adults. Considering younger teens are also avid users (though officially under 18 aren’t counted in that stat), TikTok might have total users on par with, or even exceeding, half of all internet users. Short-form video content – dances, comedy skits, lip-syncs – appeals to the youthful demographic, and a number of young Comorians have started creating and sharing their own TikToks, some garnering thousands of views. TikTok’s engagement is high, but again constrained by data costs; many users will consume content in bursts. For businesses, TikTok is an emerging channel: a few local brands and numerous informal businesses have begun experimenting with TikTok videos to showcase products or simply build brand awareness among young consumers.

Instagram – Instagram’s user base in Comoros is relatively small (Meta’s data shows about 27,000 Instagram users in early 2024, roughly 3–4% of the population). It tends to be used by the urban elite, young professionals, and diaspora-connected youth who enjoy its visual-centric format. Instagram is favored for sharing personal photos, fashion, and following global trends. Local influencers are few but some Comorian photographers, models, and public figures maintain active Instagram profiles. Businesses in sectors like fashion, beauty, and tourism maintain Instagram accounts to advertise visually appealing products (e.g., a hotel posting scenic photos). However, the platform’s reach is much narrower than Facebook’s in Comoros, so it’s often seen as a complement to a Facebook presence.

Twitter (X) – Twitter has only a niche presence in Comoros. It’s used by a small number of journalists, tech enthusiasts, and political commentators. The user base might be in the low thousands at most. In late 2023, data suggested Twitter’s active reach was under 1–2% of the population and even shrinking. As a result, Twitter (now rebranded as X) is not a major platform for general marketing, though it can be a way to connect with the Comorian diaspora and follow international conversations. Government agencies and a few politicians have Twitter accounts to broadcast official news, but ordinary citizens largely do not use Twitter for daily communication.

LinkedIn – The professional network LinkedIn has minimal usage in Comoros, given the small size of the formal corporate sector. A handful of professionals and students maintain profiles, often those who have studied abroad or are seeking opportunities internationally. It’s not a key channel for internal marketing but could be relevant for B2B outreach or recruiting the diaspora talent.

Other apps – Facebook Messenger is widely used in tandem with Facebook. Facebook Messenger had around 171,000 users reachable by ads (about 20% of population) indicating many Facebook users utilize the messenger for chats. Telegram is used by certain groups (possibly tech-savvy youth or for specific interest group chats) but is far less popular than WhatsApp. Signal and other niche secure messengers are even less common. Local news websites and forums have limited traction – most people get news via social media sharing or radio/TV. A few local sites (like Al-Watwan, a national newspaper’s site) and community Facebook groups serve the function of local news dissemination online.

In essence, the online ecosystem is dominated by a few big international platforms which serve multiple functions – communication, news, entertainment, and commerce. There are no significant indigenous social media platforms or large local web portals exclusive to Comoros that compete with these global services. This simplifies the strategy for marketers (focus on the known global platforms), but it also means reliance on external algorithms and infrastructure (if Facebook experiences an outage or policy change, a lot of Comoros’ online communication could be affected).

Country Code Top-Level Domain (.km)

Comoros’s official country code top-level domain (ccTLD) is .km. Introduced in 1998, .km is meant for websites associated with Comoros (similar to .uk for the United Kingdom or .ke for Kenya). However, the adoption of .km locally has been quite limited. There are a few second-level domains under .km, such as:

.com.km for commercial entities,

.org.km for organizations,

.gov.km for government institutions,

.edu.km for educational institutions.

In practice, relatively few websites use the .km domain due to historical challenges. For a long time, registering a .km domain was expensive and cumbersome, requiring a local presence and manual processes through Comores Telecom (which manages the registry). As a result, many Comorian businesses or projects simply opted for generic domains like .com or .org, or sometimes the French ccTLD .fr (given Comoros’ Francophone orientation). For example, a number of Comorian hotels, NGOs, or enterprises might have a .com website rather than a .km one.

The Comorian government websites themselves do use .gov.km (for instance, the central bank is banque-comores.km, some ministries have .km sites, etc.), but their maintenance is irregular. Some government sites are outdated or were down for extended periods, leading to a reliance on social media pages for up-to-date info.

For marketers and companies operating in Comoros, having a .km domain is not seen as essential – brand trust is more derived from community presence and word of mouth than domain usage. However, if targeting local consumers, a .km email or website could impart a sense of local legitimacy or national pride. There have been talks of revamping the .km registry to make it more accessible and to encourage more local content online, in line with the broader digital strategy. If the incubator and tech training initiatives succeed, one might expect more local startups and content creators to register .km domains for their projects.

It’s also worth noting an interesting side story: some country domains become valuable as domain hacks or for abbreviations (like .io for tech or .ai for artificial intelligence companies). The .km domain, coincidentally, might be read as shorthand for “kilometer,” but it hasn’t found any notable global niche use. A few creative uses like “mar.km” for marketing or “tea.km” for teams could exist, but these are not common. The Comorian authorities have kept .km primarily for genuine national use rather than selling it widely to foreigners.

In summary, .km is Comoros’s digital call sign, but its practical impact on the digital ecosystem is minimal so far. Most digital engagement happens on platforms that use generic domains (Facebook.com, etc.) or via apps. As the local digital ecosystem grows, it will be interesting to see if .km domains become more prominent for local businesses and e-government services.

Prominent Comorian Companies Operating Online

The landscape of Comorian companies with an online presence is relatively small, given the scale of the economy. However, there are a few key players and rising stars in the online and technology space worth noting:

Telecom Operators: The telecom companies are arguably the most prominent entities in Comoros’s online sphere, since they not only have websites but also power the connectivity for everyone else.

Comores Telecom (Huri) – The state-owned incumbent, which operates the Huri mobile network, maintains a web portal (comorestelecom.km) where customers can find information on tariffs, recharge accounts, and access services like email. Comores Telecom also has a presence on social media and promotes its offerings (like “Huri Yatru” app and “Huri Money” mobile money) online. As a legacy operator, it’s a well-known brand nationwide.

Telma Comores – The challenger telecom operator has a more modern online presence reflecting its private ownership. Telma Comores (often just called Telma) uses its website and Facebook page to market data bundles, SIM registration drives, and its MVola mobile money service. It positions itself as the innovative, youthful brand (bringing in 4G, etc.), and engages in digital marketing campaigns and user engagement on platforms like Facebook. Telma’s parent Axian group often highlights Telma Comores as a success story in bringing high-speed mobile internet to Comoros.

Banks and Financial Services: Banks in Comoros are starting to offer online and mobile services, though internet banking is still not widespread.

Banque Centrale des Comores (Central Bank) – While not a commercial company, the central bank’s initiatives greatly influence the financial digital ecosystem. It is spearheading the National Financial Inclusion Strategy and has introduced a real-time gross settlement system. The central bank’s website provides regulatory info and occasionally hosts statistics, but more impactful is its support for mobile money and fintech development, which it publicizes online.

Exim Bank Comores – Part of the Exim Bank group (originating from Tanzania), Exim Bank is one of the largest commercial banks in Comoros. It offers online banking portals for customers to check balances and transfer funds (targeted mostly at corporate clients and diaspora). The bank actively uses social media to advertise loan products or savings accounts. It’s also connected to mobile money systems, allowing customers to move money between their bank account and mobile wallets.

SNPSF (Postal Bank) – The National Post and Savings Bank has had struggles (it’s undergoing restructuring), but it does have branches across islands and is expected to modernize. They have piloted an ATM network and may launch mobile banking post-reforms. For now, their online presence is minimal (mostly informational).

Retail and E-commerce: Formal e-commerce is nascent. There isn’t an Amazon or Jumia operating locally, given the small market. However, informal e-commerce thrives on social media.

Local marketplaces on Facebook – While not companies per se, there are Facebook groups like “Vente et Achat Comores” (Sale and Purchase Comoros) where thousands of members trade items (clothes, electronics, appliances). These groups function as peer-to-peer online marketplaces. Some enterprising individuals act as moderators and take a cut or promote their own goods. Essentially, Facebook is the main platform for e-commerce transactions, substituting for a proper e-commerce website.

Diaspora-driven services – Some diaspora entrepreneurs have created online services targeting Comoros. For example, websites or apps that allow someone abroad to purchase goods or services for their family in Comoros. One hypothetical example: a France-based Comorian sets up a website where diaspora can order a delivery of groceries or a tank of cooking gas to a home in Comoros, paying online, and a local partner fulfills it. Such services exist in some form (perhaps not widely branded, sometimes coordinated over WhatsApp). They may not be big “companies” yet, but represent an emerging digital business model.

Travel and Tourism:

Airlines: There are a couple of small airlines such as AB Aviation and Int’Air Îles that operate inter-island and regional flights. They have websites for flight schedules and booking. AB Aviation, for instance, lets customers book tickets online (although many still buy via agents or at the airport). Having online booking is crucial as they serve diaspora visitors planning trips home.

Hotels and Tour Operators: A few hotels in Moroni (like Golden Tulip Grande Comore or Retaj Moroni) have a web presence and appear on international booking sites. Local tour operators or guides often use Facebook pages or travel forums to connect with potential clients. As tourism grows slightly, these services are becoming more digitally visible (on TripAdvisor, Facebook, etc.).

Media: Comoros’s media outlets are extending online.

Al-Watwan (the government-owned national newspaper) has a website and a very active Facebook page where it shares news articles daily. Many Comorians online follow these pages for official news.

Lagazettedescomores (an independent paper) also has an online version. Radio stations like Radio Océan Indien stream content via the internet, and some have Facebook live sessions. Media presence online is important given the population abroad that wants to keep up with local news.

Local Tech and Startups: While still few, there are budding tech entrepreneurs:

The planned digital incubator (funded by AfDB) could boost startups. Already, small ventures exist such as young developers making mobile apps for local needs (for instance, an app to learn the Comorian language, or a platform to connect tutors with students). There was a recent hackathon that led to prototypes for an online marketplace for farmers and an e-health appointment system. These startups are not widely known yet but show the potential of a tech scene.

YAS Comoros – This is an interesting initiative: YAS is a brand under the GSMA’s Mobile for Development program, working with Telma’s MVola mobile money. It provides digital financial services (like loans, savings via mobile) under the MVola platform. Essentially it’s a fintech service targeted at Comorian users to deepen usage of mobile money beyond just transfers. YAS Comoros operates online in the sense that it’s an app-based service, and it’s promoted on social channels.

In summary, the prominent players online in Comoros are led by telecommunications and financial service companies, followed by the small but growing e-commerce and media sectors. Unlike larger economies, Comoros doesn’t have dozens of major corporate websites or a large e-commerce portal. Instead, what stands out is how traditional sectors are leveraging online tools in a constrained way: telcos pushing mobile apps and services, banks offering online access, and everyday commerce moving onto Facebook and WhatsApp in absence of formal platforms. For an investor looking at Comoros’s digital corporate landscape, telecommunications clearly stands out as the success story so far (with active competition and innovation). For a marketer, the implication is that partnerships with or advertising through these prominent companies (e.g., collaborating with a mobile operator’s app, or running a campaign with a bank’s mobile service) could be effective channels, given their reach and trust in the local market.

Online and Digital Marketing Landscape

Social Media and Digital Marketing Usage by Businesses

Given the relatively low internet penetration, one might expect digital marketing to be a minor part of the business toolkit in Comoros. However, among the connected segment of the population, social media has quickly become a vital marketing and customer engagement channel. For many businesses – from small informal vendors to larger companies – Facebook and WhatsApp are the primary digital marketing platforms.

Facebook for Business: Businesses in Comoros, whether a neighborhood boutique or a telecom company, almost invariably have a Facebook page if they have any online presence at all. It’s common to see shops put up signs saying “Retrouvez-nous sur Facebook” (Find us on Facebook) with their page name. These pages are used to post updates on products, prices, and promotions. For example, a clothing store will post photos of new dresses that arrived, a restaurant will share its daily menu or pictures of dishes, and an events organizer will create Facebook events to promote an upcoming concert or conference. One reason Facebook is so central is that it provides a free, easy-to-use platform that does not require technical skills to maintain (unlike managing a website). It also has an immediate audience ready – the ~237k users locally – plus diaspora followers who might be interested.

Many businesses also leverage Facebook’s advertising tools in a rudimentary way. Even with a small budget of a few thousand KMF, they can “boost” a post to reach more people in Comoros. Given the limited competition for local eyeballs, a little spend can go a long way. Facebook ads allow targeting by location (e.g., show to people in Moroni or in a certain age bracket), which businesses find useful. A local mobile phone retailer might run a targeted campaign for new smartphone arrivals, or a bank might advertise a new loan product aimed at salaried workers.

WhatsApp for Business: A lot of commerce happens through WhatsApp, albeit less in a broadcast advertising sense and more in a relationship management sense. For example, taxi drivers and delivery services circulate their WhatsApp numbers so customers can reach them easily. Restaurants encourage orders via WhatsApp messages. There’s also widespread use of WhatsApp group chats for promotional purposes – communities might have a “deals” group where sellers post daily offerings. Some entrepreneurial individuals act as influencers or moderators in WhatsApp groups, curating deals or advertising their own products to members. With the rollout of the official WhatsApp Business app, a few SMEs have started using features like business profiles, quick replies, and catalog listings within WhatsApp to appear more professional.

Instagram Influencers and Visual Marketing: Although Instagram’s audience is smaller, it is valued for reaching a trend-conscious demographic. A handful of Comorian influencers have emerged on Instagram (and TikTok) – for example, a beauty blogger showcasing hijab fashion, or a fitness trainer sharing workout tips. These influencers sometimes collaborate with businesses. A cosmetics shop might give free samples to an Instagram influencer to demonstrate in a tutorial, thereby indirectly marketing the product. Visual-heavy sectors like travel/tourism, food, and fashion use Instagram to build a certain brand image that appeals to aspirational consumers and diaspora (who might sponsor locals or bring gifts).

TikTok and Video Marketing: The explosion of TikTok usage among youth hasn’t gone unnoticed by businesses. In the last year or so, some brands have started their own TikTok accounts to share lighthearted content. For instance, a telecom company could post a short comedic sketch about running out of data to subtly promote their data bundles, or a local snack brand might film young people enjoying their product in a trendy format. Because TikTok content can be shared to Facebook/WhatsApp, one video can propagate across platforms. That said, TikTok marketing is still very new in Comoros; it’s largely organic content now rather than paid advertising (TikTok’s ad system is less used by local businesses yet).

Content Localization: Successful digital marketing in Comoros often requires mixing languages and cultural references effectively. Many businesses post in French, as it is the language of formal business and widely understood among literate populations. However, to connect emotionally, marketers often sprinkle in Shikomori (the Comorian language) phrases or even write entire posts in Shikomori (using Latin script, as is common informally). For example, a phone company ad might say “Bon marché! Huri Imédi!” combining French for “Cheap!” and Comorian for “Call now!”. During holidays like Eid or Independence Day, digital campaigns commonly use greetings in Arabic (“Eid Mubarak”) or Comorian to resonate culturally. This code-switching strategy reflects the trilingual nature of Comorian society and helps broaden appeal.

Mix of Traditional and Digital: It’s important to note that digital marketing hasn’t replaced traditional marketing in Comoros; rather, it complements it. Radio is still one of the most effective channels to reach the masses, especially in rural areas. Many companies sponsor radio programs or run simple ads via the national radio and local FM stations. Outdoor advertising (billboards in Moroni) and printed flyers are also used. A typical marketing campaign by a major brand (say, a telecom operator launching a new offer) will use a mix of radio jingles, SMS blasts, billboards, and Facebook posts. SMS remains a key tool because even non-internet users can be reached – operators often send out bulk SMS notifications for clients (like a bank might SMS its customers about a new service). Those SMS may include a link to a website or prompt to visit a Facebook page for more info, thus bridging traditional and digital.

E-commerce and Mobile Commerce Trends

E-commerce in the formal sense – online shopping via websites or apps with electronic payments – is still at an embryonic stage in Comoros. Several factors contribute to this: low internet penetration, limited electronic payment options, and logistical challenges across islands. However, commerce via digital means is happening informally, primarily through social networks and mobile money, which can be termed social commerce or m-commerce (mobile commerce).

A few noteworthy developments and trends:

Classifieds and Peer-to-Peer Sales: As mentioned, Facebook groups function as the primary e-commerce marketplace. Think of them as a local version of Craigslist or Facebook Marketplace, where individuals list items for sale (used phones, clothing, furniture, etc.) and interested buyers comment or message to negotiate. Payments often occur offline (cash on meeting) or increasingly via mobile money transfer once trust is established.

Mobile Money as a Payment Tool: The advent of mobile money services is a game-changer for e-commerce potential in Comoros. With Huri Money (Comores Telecom) and MVola (Telma), users can store and send money using their phones. In 2023, about 53% of Comorian adults reported having used mobile money, which is higher than those with bank accounts. This means more than half the population has at least some access to digital financial services even if they lack formal banking. For businesses, this opens the door to accept payments remotely. For example, a small grocery store can take payment via a mobile money transfer and then dispatch goods with a delivery person. We’re seeing the early stages of this – some entrepreneurs advertise that they accept MVola or Huri Money, so customers from a different island or abroad can pay easily.

Emerging Online Retailers: A couple of startups and established retailers have launched online catalogs. For instance, there’s an electronics shop in Moroni that created a basic e-commerce website listing phones and laptops for sale, with a “request order” form (though the actual payment and delivery might still be handled manually). Also, an agricultural cooperative recently tested an online platform for farmers to sell produce directly to consumers in town – essentially an online farmers’ market concept, aiming to cut out middlemen. This was part of a development project and shows the interest in leveraging digital means to improve market access.

Cross-Border E-commerce: With a large diaspora, an interesting facet is diaspora-driven e-commerce. Rather than locals buying from foreign sites, it’s often diaspora buying for locals. For instance, a Comorian living in Paris might order a gift for their family in Comoros using a France-based site or sending a package via a specialized shipper. There are a few services (not mainstream e-commerce sites, more like concierge services) where diaspora can select items (like appliances or furniture) and a local provider in Comoros fulfills the delivery. This segment is expected to grow if trust and payment can be streamlined – essentially a form of “cross-border e-commerce” where the buyer is abroad and the seller is local, opposite of normal e-commerce.

International Platforms: Currently, international e-commerce platforms have limited direct presence. Sites like Amazon or AliExpress are accessible to Comorian internet users, but ordering from them is not straightforward. Delivery to Comoros is a challenge – postal service is slow and not always reliable. Nonetheless, some individuals do order from AliExpress (small cheap items like phone accessories) and wait months for delivery, or they use freight forwarders for pricier goods (like someone might order a laptop to an address in Kenya or France and then bring it over). As infrastructure improves, one can foresee companies like Jumia (a pan-African e-commerce firm) possibly eyeing Comoros as an extension market, especially since Jumia operates in neighboring Madagascar. But at present, volumes are too low to justify formal operations.

Regulatory Environment for E-commerce: Comoros does not yet have a comprehensive e-commerce law or consumer protection specific to online transactions. General contract law and trade law apply. However, the government, through support from organizations like UNCTAD and the WTO accession process, has signaled an intention to update its legal framework to accommodate digital trade. This includes:

Drafting of laws for electronic transactions (to recognize electronic signatures, digital contracts, etc.).

Cybersecurity and cybercrime legislation to protect consumers and businesses online (important for trust).

Data protection law (as evidenced by setting up a Data Protection Authority via the AfDB project), which will be crucial when more services collect personal data.

Possibly simplifying customs procedures for low-value goods if e-commerce imports rise (part of WTO commitments likely touches on de minimis rules for imports). For now, businesses engaging in e-commerce operate somewhat in a gray area – they follow basic business licensing, but no special license is needed for selling online. It will be important for them to stay informed as new regulations come into play in coming years.

Use of Digital Tools and Behaviors

Comorian businesses and entrepreneurs have been adaptive in using digital tools that suit their context:

SMS Marketing: As noted, SMS blasts are common. Banks send promotional texts, telecoms send daily offers (e.g., bonus airtime messages), and even political campaigns use SMS to reach voters. SMS has near 100% phone penetration reach. Some savvy small businesses use services (often provided by the mobile operators) to send out promotional SMS to their customer lists during peak shopping times or around holidays.

Email Newsletters: These are not as common for local businesses, since email usage is limited. But for targeting diaspora or professionals, a few organizations do email marketing. For example, a travel agency might maintain an email list of clients abroad to announce flight deals to Comoros.

Radio & Facebook Synergy: Local radio shows sometimes encourage listeners to continue the discussion on Facebook. One popular youth radio show in Moroni has a Facebook group where they post topics and get feedback, which then feeds into the on-air content. Businesses sponsoring such shows get mentions both on-air and online, maximizing engagement.

Influencer and Word-of-Mouth Marketing: In a small community like Comoros, word-of-mouth is powerful. This has translated online in the form of micro-influencers. A respected individual or a popular social media personality can sway opinions. Businesses often invite such personalities to their events or give them freebies hoping they’ll post about it. For example, when a new café opens in town, they might host a “social media night” where they invite young bloggers and photographers to try the menu for free – the buzz generated online after that can be substantial in the local context.

Localized Content: Companies are learning to create content that resonates locally. A good instance is the telecom ads – Telma launched an online video series featuring a comedic character who deals with humorous situations solved by using more data or mobile money, delivered in Comorian language with French subtitles. These short videos were shared widely because they were funny and culturally relevant, indirectly advertising Telma’s services. In another case, a health NGO ran a campaign on Facebook around COVID-19 awareness, using local religious leaders and doctors in short clips speaking in Comorian to convey important messages – it gained trust and high sharing because of the local touch.

SEO and Web Presence: For the few with websites, search engine optimization is not a big focus due to limited competition on search queries. More critical is being discoverable on Google Maps and social media. Many businesses ensure their location and contact are on Google Maps/Google My Business, as tourists and diaspora often rely on Google for directions and reviews. For instance, restaurants and guesthouses actively ask patrons to leave a Google review or TripAdvisor review, knowing that a lot of overseas-originating business depends on online reputation.

Challenges and Considerations in Digital Marketing

Despite the increasing importance of digital channels, marketers face challenges:

Limited Audience Size: As highlighted, only ~1/3 of the population is online. If a campaign is purely digital, it misses a majority of potential consumers who are offline. This is why many businesses still invest in multi-channel marketing, ensuring radio, TV, or print carry their message alongside Facebook. An investor launching a product in Comoros should not rely solely on digital; a ground presence and traditional media remain key for broader reach as of 2024.

Low Conversion Rate: Even when reaching people online, converting views into sales can be tough. Many online interactions end with inquiries like “price?” or “how can I get this?”, but then logistical barriers (no home delivery system, needing to physically meet to exchange goods) can cause drop-off. Businesses often have to arrange some delivery or pickup options to make the online interest translate to an actual transaction.

Payment Issues: Until very recently, lack of electronic payment was a big hurdle for e-commerce. With mobile money, some payments are now possible digitally, but integration of payment gateways into websites is still absent. There’s no widely used local equivalent of PayPal (though people do use services like Western Union or MoneyGram for sending money, those aren’t web APIs for shopping carts). So if someone sees an item on a Facebook page and wants it delivered, they typically have to either pay cash on delivery or separately send money via mobile money. The friction in that process can deter impulse buys. Improvements in the mobile money ecosystem – like easier merchant payments and maybe QR code scanning – could streamline this in the future.

Skills Gap: Many small business owners aren’t well-versed in digital marketing techniques. They may know how to make a Facebook post, but not how to analyze engagement or run targeted ad campaigns beyond boosting posts. This is an opportunity for digital marketing agencies or knowledgeable freelancers in Comoros. Indeed, a few young professionals have begun offering services to manage social media for businesses. Training programs in digital marketing are needed to upskill entrepreneurs. The more local businesses see success stories of others growing via online outreach, the more they will seek to improve their own digital skills.